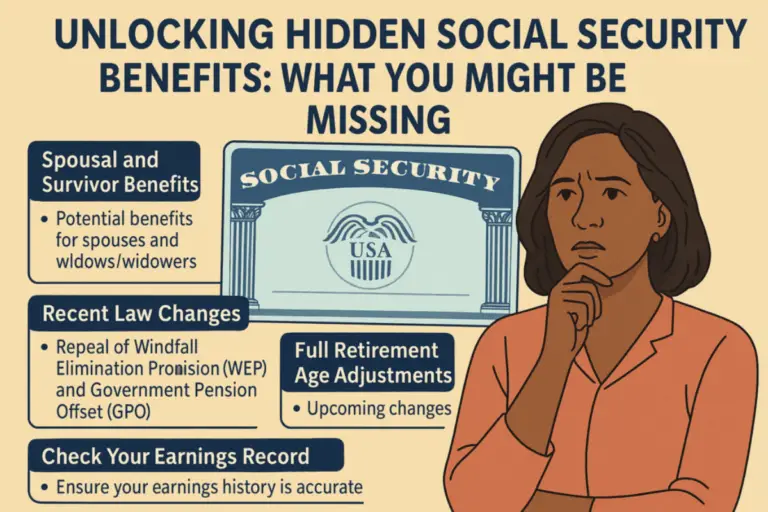

Don’t Leave Money on the Table: Hidden Social Security Benefits You Might Be Missing

By Kristin Michelle | KM Insurance Planning

Spousal and Survivor Benefits: Are You Eligible?

- Spousal Benefits: If you’re married or divorced (and the marriage lasted at least 10 years), you might be entitled to up to 50% of your spouse’s benefit – even if you’ve never worked. This applies even if your ex-spouse has remarried.

- Survivor Benefits: Widows and widowers can receive benefits based on their deceased spouse’s earnings. Eligibility can begin as early as age 60 (or 50 if disabled). Even divorced spouses may qualify if the marriage lasted at least 10 years and they haven’t remarried before age 60.

Spousal, Survivor & Ex-Spouse Benefits: Choose the Highest Check

If you’ve been married more than once, you can collect spousal or survivor benefits based on the ex-spouse with the highest Social Security earnings – as long as each marriage lasted 10 years or more.

Key Points:

- You only receive one spousal benefit, but it’s based on whichever ex-spouse gives you the bigger check.

- You don’t need your ex’s permission to claim, and they won’t be notified.

- This applies even if they’ve remarried.

- You can collect survivor benefits from a deceased ex-spouse if eligible.

Pro Tip:

If your own Social Security benefit is lower than 50% of your ex’s full retirement benefit, the spousal benefit could increase your monthly income.

Recent Law Changes: The Social Security Fairness Act

In January 2025, the Social Security Fairness Act was signed into law, repealing the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). This change benefits over 3.2 million retired public workers, such as teachers and police officers, by increasing their Social Security payments. Some beneficiaries have already received retroactive payments averaging $6,710.

Why the Social Security Fairness Act Matters

The Social Security Fairness Act was designed to fix an unfair reduction in benefits that hurt public sector workers – like teachers, firefighters, police officers, and government employees – who also paid into Social Security at other jobs.

Two old rules caused the problem:

- Windfall Elimination Provision (WEP): Reduced Social Security benefits for people who earned a public pension but also paid into Social Security through side jobs or second careers.

- Government Pension Offset (GPO): Reduced (or wiped out) spousal and survivor benefits for public workers who got a pension from a job where they didn’t pay Social Security taxes.

The problem?

These workers paid into Social Security – just like everyone else – but were getting penalized, sometimes losing thousands in monthly benefits, even after decades of paying into the system.

The Fairness Factor:

- WEP & GPO were meant to prevent “double-dipping,” but they overcorrected and unfairly hurt middle-class retirees.

- Many public employees had lower lifetime earnings, yet still faced big Social Security cuts.

- The new law restores fairness by treating all workers equally based on what they paid into Social Security.

Who Benefits Most?

- Retired teachers, police, firefighters, and government workers with mixed work histories.

- People who worked public jobs + private sector jobs now get the full benefit they earned.

- Spouses and widows/widowers of affected workers regain access to fair survivor benefits.

Importance of Checking Your Earnings Record

Your Social Security benefits are calculated based on your earnings history. Errors can lead to reduced benefits. Most people NEVER confirm their record is correct, It’s crucial to:

- Review Your Earnings Record: Create a “my Social Security” account at ssa.gov to access your earnings history. Do this sooner rather than later to avoid payment delays.

- Report Discrepancies Promptly: If you notice any errors, report them immediately to ensure your future benefits are accurate.

Upcoming Changes: Full Retirement Age Adjustments

Starting November 2025, individuals born in 1959 will reach their full retirement age (FRA) of 66 years and 10 months. Delaying benefits until FRA can result in over 28% more in monthly payments compared to claiming at age 62.

Born in 1960 or later: Full Retirement Age (FRA) is now 67

Key Takeaways

Maximizing your Social Security benefits requires awareness and proactive management. By understanding potential benefits, staying informed about legislative changes, and regularly reviewing your earnings record, you can ensure you’re receiving the full benefits you’re entitled to.

Need assistance navigating your Social Security options? Feel free to reach out for personalized guidance.

Let’s talk. A personalized strategy can help you make the most of your money.

Email us Info@KMbenefits.com or Schedule a Meeting.